Pay At Your

Own Pace With

We Offer A “Buy Now, Pay Later” Option

Split invoices into easy monthly payments 3, 6, 12, 18 or 24 months

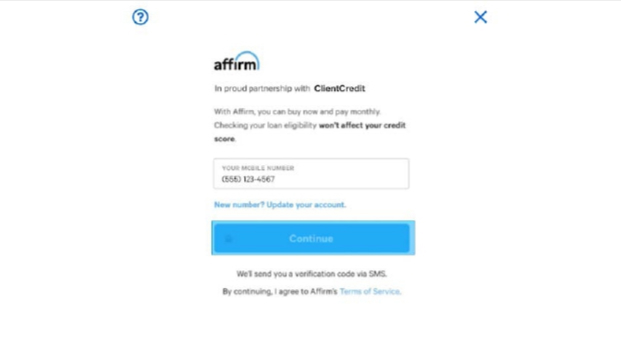

● Applying is quick & easy

● Checking eligibility won’t impact your credit score

● No hidden fees, no late fees—ever

● No compounding interest

● What you see is what you pay

● Set up easy, automatic payments

● Applying is quick & easy

● Checking eligibility won’t impact your credit score

● No hidden fees, no late fees—ever

● No compounding interest

● What you see is what you pay

● Set up easy, automatic payments

PAY WITH AFFIRM IN THREE EASY STEPS

1. On the firm’s checkout page, select the payment option “Pay Later” to apply for Affirm financing.

2. Complete a simple application and select the monthly payment terms that fits your needs.

3. Confirm your loan to complete the bill payment.

*Your rate will be 0–30% APR based on credit, and is subject to an eligibility check. For example, a $500 purchase might cost $45.15/ mo over 12 months at 15% APR. Payment options through Affirm are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required.

The Process

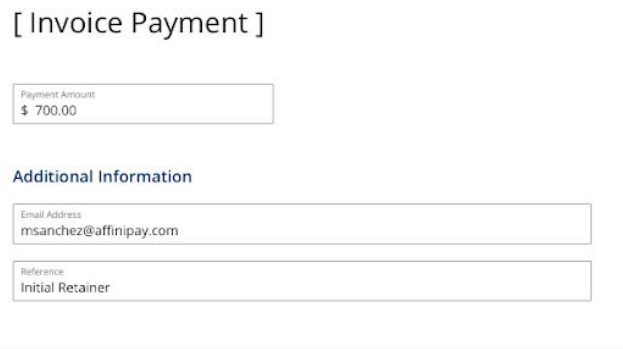

1. Consumer/Client will arrive on

1. Consumer/Client will arrive on

the secure payment page and

enter the payment amount in

addition to consumer/client’s

email address and memo for

the payment.

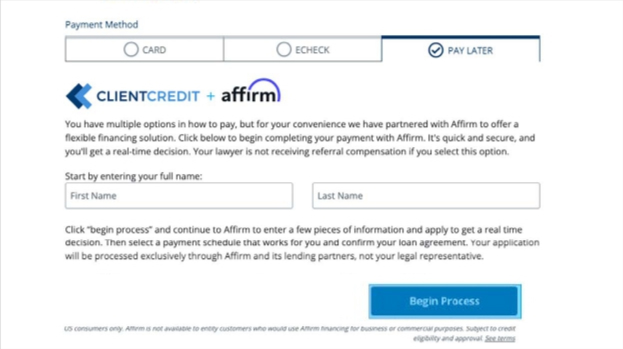

2. Consumer/Client will see a“Pay Later” option on thesecure payment page.

3.  Selecting this option will

Selecting this option will

take consumer/client to an

online application for funding

through Affirm. ClientCredit

works with Affirm to provide

consumer/client with access

to this financing option.

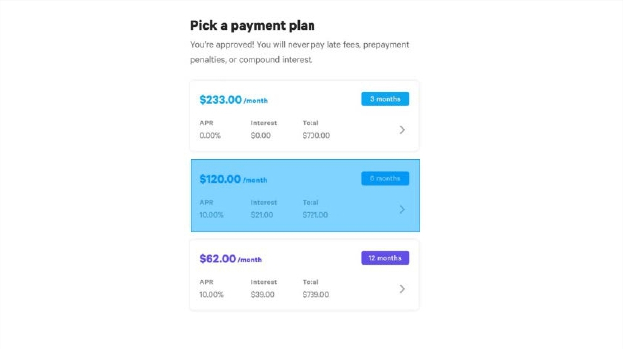

4.  Once an account is created,

Once an account is created,

consumer/client may receive

an offer for various payment

plans.

5.  After selecting the desired

After selecting the desired

payment plan option and

accepting its terms and

conditions, consumer/client

will be redirected to the

payment confirmation page.

6. Consumer/client will receive a notification email confirming the Affirm financing transaction.

1. Consumer/Client will arrive on

the secure payment page and

enter the payment amount in

addition to consumer/client’s

email address and memo for

the payment.

2. Consumer/Client will see a“Pay Later” option on thesecure payment page.

3. Selecting this option will

take consumer/client to an

online application for funding

through Affirm. ClientCredit

works with Affirm to provide

consumer/client with access

to this financing option.

4. Once an account is created,

consumer/client may receive

an offer for various payment

plans.

5. After selecting the desired

payment plan option and

accepting its terms and

conditions, consumer/client

will be redirected to the

payment confirmation page.

6. Consumer/client will receive a notification email confirming the Affirm financing transaction.

Frequently Asked Questions

* Your rate will be 10–30% APR based on credit and is subject to an eligibility check. For example, a $700 purchase might cost $63.25/mo over 12 months

at 15% APR. Payment options through Affirm are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and

a down payment may be required.